NIH/AHRQ Childcare Costs

Summary

NIH and AHRQ provide childcare costs through their Ruth L. Kirschstein National Research Service Award (NRSA) fellowships and institutional training grants to help defray the high cost of childcare and encourage family-friendly work environments for NRSA-supported graduate students and post-doctorates. Below you will find important information on how to request these costs in proposals, eligibility requirements, allowability of costs, reimbursement and reporting. For additional information from NIH and AHRQ's, see the side bar of this webpage.

Childcare Reimbursement Form

- NIH/AHRQ Fellowship and Training Grant Childcare Reimbursement Form (v1, 12/5/2023) Download first, save file, then complete. Do not complete in your browser.

Jump To (by topic):

- General Information on Eligibility and Allowable Costs

- Requesting Childcare Costs

- Award Setup

- Notification to Fellows/Trainees

- Rebudgeting and Prior Approvals

- Reimbursement of Childcare Costs and Year End Tax Reporting

- Progress Reporting Requirements

- Financial Reporting of Childcare Costs

General Information on Eligibility and Allowable Costs

The NRSA childcare costs apply to full-time NIH-NRSA supported fellowship positions (F30, F31, F32, and F33), and to full-time predoctoral or postdoctoral trainees on NIH-NRSA-supported institutional research training awards (T32, TL1, TU2 and T90).

Specific AHRQ-funded fellowships and training grants also provide this benefit (see NOT-HS-22-013 and NOT-HS-22-014).

Childcare costs must be awarded on the grant Notice of Award (NOA) in order to serve as proof of eligibility to the fellow or trainee.

Each fellow or trainee may receive $2,500 per budget period for childcare costs.

For households where both parents are NRSA fellows or trainees, each parent is eligible to receive $2,500. The childcare cost amount is not determined by number of children.

Childcare costs must be awarded on the grant’s Notice of Award in order to serve as proof of eligibility to the fellow or trainee.

Childcare costs are permitted for dependent children living in the eligible fellow or trainee’s home from birth under the age of 13, or children who are disabled and under age 18. This is inclusive of foster/adoption and part-time custody situations where the child is of appropriate age.

The childcare costs do not apply to elder or non-child dependent care costs.

Eligible childcare under the childcare cost is care that is licensed and/or regulated by state and/or local authorities, including, but not limited to:

- Childcare at a day camp, nursery school, or by a private sitter

- Before- or after-school care, pre-schools

- Licensed day care centers

- Summer or holiday day camps

NOTE - The types of childcare service providers that are licensed and/or regulated can vary by state. One resource for verifying childcare license requirements by state is Childcare.gov (state resources).

Requesting Childcare Costs

The following outlines how childcare costs are requested for fellowships and training grants. Questions concerning how childcare costs are requested should be directed to the SPA Project Officer.

NIH fellowships: applicable to F30, F31, F32, and F33

AHRQ fellowships: applicable to F32 only

If individual fellows would like to receive the childcare benefit, the benefit must be formally requested to NIH or AHRQ in their original fellowship proposals, Research Performance Progress Reports (RPPRs) or through an Administrative Supplement.

Proposals:

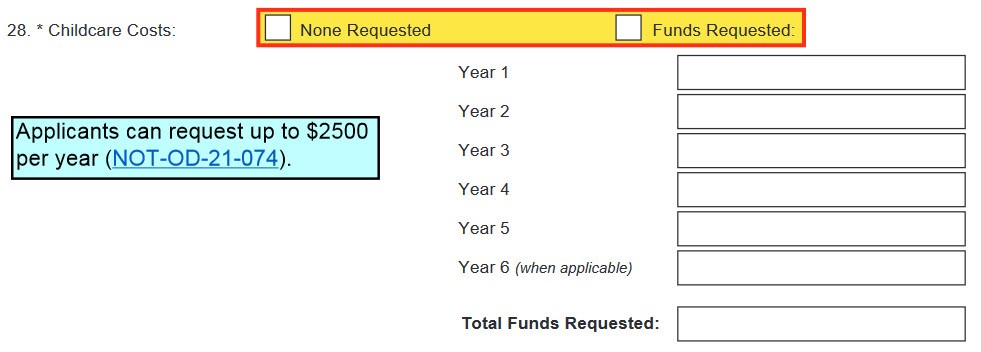

Childcare costs must be requested in field 28 (labeled as Childcare Costs) of the PHS Fellowship Supplemental Form. See the FORMS-H PHS Fellowship Supplemental Form application instructions. See PHS Fellowship Supplemental Form screen shot:

Current NIH or AHRQ NRSA fellows may request childcare costs for future years via the Research Performance Progress Report (RPPR). In Section G.1 of the RPPR, recipients must upload a PDF named “Childcare_Cost_Request.pdf” (without quotation marks). The attachment must specify the requested childcare costs amount and number of years requested. Applicants are strongly encouraged to request childcare costs for all remaining years that the project will be funded based on the dependent(s)’ age eligibility factor. Recipients are not required to submit supporting documentation with each request. Recipients must maintain all supporting documentation (e.g., proof provider is licensed). NIH and AHRQ reserves the right to request proof at any time.

Current NIH or AHRQ NRSA fellows may request an administrative supplement to provide childcare costs on an existing award.

NIH fellows: Applications must be submitted using Notice of Special Interest (NOSI): Availability of Administrative Supplements for Childcare Costs for Ruth L. Kirschstein National Research Service Award (NRSA) Individual Fellows (NOT-OD-21-070). However, also review the CORRECTION to the NOSI (NOT-OD-21-075) for updated instructions.

AHRQ fellows: Applications must be submitted using AHRQ Administrative Supplements for Grants in Health Services Research (PA-22-168).

NIH training grants: applicable to T32, TL1, TU2 and T90

AHRQ training grants: applicable to T32 only

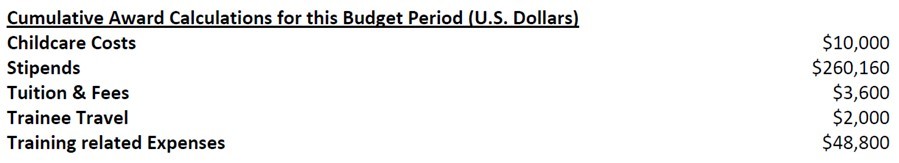

Childcare costs will generally be provided based on the number of trainee slots awarded. No additional action is needed on the part of the applicant at the time of application to request these funds. This will be indicated on the Notice of Award (NOA) in a lump sum. See example in the screen shot below, showing childcare costs were awarded in the NOA for four trainee slots, totaling $10,000 ($2,500 x 4 trainees) for the budget period:

Award Setup

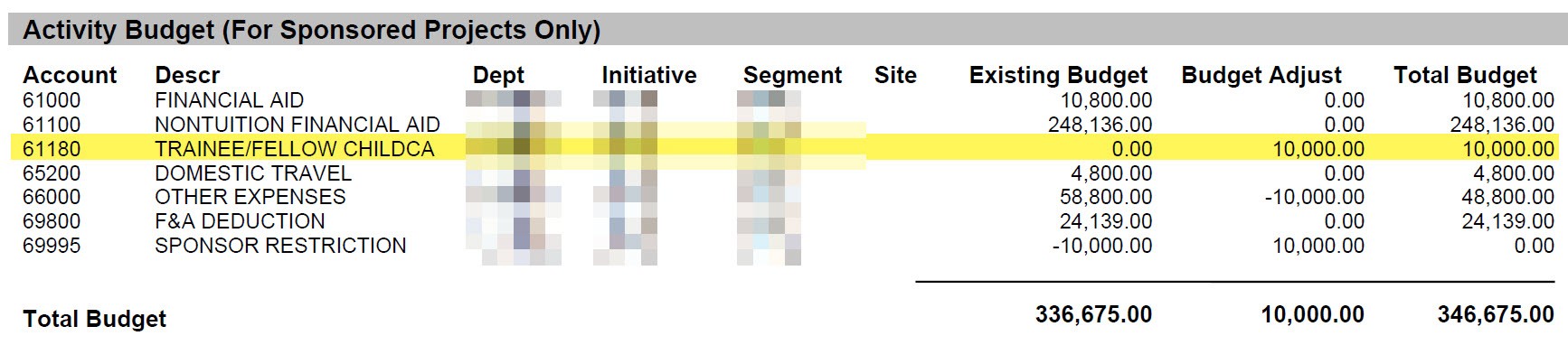

Sponsored Projects Administration (SPA) will set up awards containing childcare costs using a budget category called TRAINEE/FELLOW CHILDCARE REIMB, which is budget account 61180. This budget category will only be used for NIH and AHRQ fellowships and training grants that have been awarded childcare costs in the Notice of Award (NOA). This budget category will not be used for any other purpose. The PIN and Sponsored Projects Finance Report (SPFR) will reflect these changes.

See example PIN report below, containing budget account 61180 for childcare costs.

Notification to Fellows/Trainees

It is strongly recommended that upon the appointment of the fellow or trainee that the PI/Department notify the fellow/trainee of the childcare cost benefit. This can be done on their appointment letters or via email. The following is suggested language that can be used:

Your position is eligible to receive up to $2,500 per budget period for costs for childcare provided by a licensed childcare provider. The budget period associated with your appointment is START DATE-END DATE. The funds for childcare costs are available through your appointment period, even if your appointment period overlaps more than one grant budget period. Further information about this benefit, including the process for reimbursement, is found at NRSA childcare webpage [add link].

It is important for the fellow/trainee to know that expenses must be posted to the sponsored project no later than 90 days from the date of service. Therefore, fellows/trainees should submit their reimbursement form to the department administrator soon after the date of childcare services.

Rebudgeting and Prior Approvals

NIH: Childcare costs cannot be used for any other purpose without prior written approval from the NIH awarding Institute/Center (IC).

If a child ages out mid-budget period, childcare costs will not be pro-rated. Any unobligated balance of childcare costs remaining after the child ages out may not be used for any purpose. The funds will remain unobligated and will be adjusted by the agency as part of the closeout process.

NIH Training grants: If the trainee received childcare costs, and transitions to a Fellowship award, they may be eligible to receive an additional $2,500 in the same fiscal year. The trainee/fellow should consult with the funding IC through the SPA Project Officer.

AHRQ Fellowships: When childcare costs are awarded, the funds are restricted to be used for that purpose only and at a maximum level of $2,500. Unused funds may not be re-budgeted for any purpose. In cases of early termination of a fellowship award, or in cases where a child ages-out part-way through a budget period, recipients may not expend any unused portion of the childcare costs for any other purpose. Unused childcare cost allowance funds remain unobligated and will be recovered by the agency as part of the closeout process.

AHRQ Institutional Training Grants: When the childcare cost allowance is awarded, the funds will be restricted to be used for that purpose only and at a maximum level of $2,500 per eligible full-time predoctoral or postdoctoral NRSA trainee. Unused funds must be reported as an unobligated balance on the Federal Financial Report (FFR). AHRQ will utilize unused funds as an offset to a future year award or will recover the funds as a part of the closeout process, as appropriate.

Reimbursement of Childcare Costs and Year End Tax Reporting

Reimbursement of childcare expenses must be submitted through Concur. Take the following steps:

- The fellow or trainee will need to complete an NIH/AHRQ Fellowship or Training Grant Childcare Reimbursement Form (“Childcare Reimbursement Form”). The form contains a certification for the fellow/trainee to sign that all the information provided on this form is true and accurate, and that the fellow/trainee is eligible to receive the reimbursement(s) requested.

- It is important for the fellow/trainee to know that expenses must be posted to the sponsored project no later than 90 days from the date of service. Therefore, fellows/trainees should submit their reimbursement form to the department administrator soon after the date of childcare services.

- The trainee must provide the signed form along with required back-up documentation (original receipts and proof of payment) to their departmental administrator. To be reimbursed, services and supporting documentation must be from a licensed childcare provider.

- The department administrator must complete the Budget Period Begin Date and Budget Period End Date on the Childcare Reimbursement Form, along with the ARC Chartstring Information containing the sponsored project account, and a copy of the Notice of Award (NOA) demonstrating that childcare costs were awarded. The department administrator must use natural account 61181, TRAINEE/FELLOW CHILDCARE REIMB.

- The department administrator submits the Childcare Reimbursement Form in Concur. When submitting, they must use Expense Type “NIH or AHRQ Childcare Reim”.

For more information and training materials related to Concur, see Finance’s Travel and Expense Training Materials.

To be reimbursed, services and supporting documentation must be from a childcare provider that is licensed and/or regulated by state and/or local authorities.

NOTE - The types of childcare service providers that are licensed and/or regulated can vary by state. One resource for verifying childcare license requirements by state is Childcare.gov (state resources).

Documentation formats to support the cost of childcare may vary by provider. Acceptable forms of documentation may include an invoice, payment receipt, or an agreement/letter from the provider. Be sure to maintain any combination of documentation as needed so that all the criteria listed below are included:

- Full name(s) of eligible children listed on the invoice, receipt, and/or agreement

- Name of the childcare provider

- Dates of service

- Amount/cost of childcare

The childcare provider licensure details must be or have been current during the period of care that the cost was incurred. The original invoice or receipt should contain the license number of the service provider. However, if the license number is not on the receipt or invoice, another resource as proof of a licensed provider is to download, take screen shots, or print to PDF the provider’s license information from a state or local authority’s website. The following sites are a sampling of listings where license numbers can be obtained, but are not limited to only these:

The submission of the Childcare Reimbursement Form in Concur will trigger a 1099-MISC tax form to be distributed to the fellow/trainee following the end of the calendar year. For more information see Year-End Tax Reporting Documents.

Progress Reporting Requirements to NIH/AHRQ

NIH and AHRQ Fellows: If childcare costs were previously requested and awarded, recipients must report on their annual RPPR if childcare costs continue to be needed or not in section G.1 Special Notice of Award and Funding Opportunity Announcement Reporting Requirements of the RPPR.

NIH and AHRQ Institutional Training Grants: Recipients must upload a PDF named “Childcare_Costs.pdf” (without quotation marks) in Section G.1 of the RPPR. The attachment must specify the number of trainees who used childcare costs in the reporting period. System enhancements are forthcoming that will incorporate reporting via xTrain.

Do not submit supporting documentation in the RPPR. Recipients must maintain all supporting documentation (e.g., proof provider is licensed). NIH and AHRQ reserves the right to request proof at any time.

Financial Reporting of Childcare Costs

NIH Institutional Training Grants: Similar to how NIH advises recipients to report on stipends and tuition for NRSA institutional training awards Sponsored Projects Finance (SPF) will report, eligible childcare costs that cross over budget periods as unliquidated obligations. Unliquidated obligations are commitments of the recipient and are considered to be obligations and, therefore, should not be reported as unobligated balances. As a reminder, if the Federal Financial Report (FFR) report covers the final budget period of the project period, it must have no unliquidated obligations unless there is an unliquidated balance carryover to a subsequent competitive segment. Where there is going to be an unliquidated balance, it is the responsibility of the department to notify the SPF manager not later than the required validation date or as the agency otherwise requires.

All reportable childcare costs, as of the FFR reporting date, should be provided to SPF as outlined above indicating amounts paid and unliquidated. Unused childcare balances must be reported as an unobligated balance on the FFR and NIH will utilize unused funds as an offset to a future year award or will recover the funds as a part of the closeout process, as appropriate.

When childcare costs are awarded, the funds are restricted to be used for that purpose only and at a maximum level of $2,500. Unused funds may not be re-budgeted for any purpose and overspend on other line items utilizing the childcare awarded funding must be cleared from the project’s expenses.

AHRQ Institutional Training Grants: When the childcare cost allowance is awarded, the funds will be restricted to be used for that purpose only and at a maximum level of $2,500 per eligible full-time predoctoral or postdoctoral NRSA trainee. Unused funds must be reported as an unobligated balance on the FFR. AHRQ will utilize unused funds as an offset to a future year award or will recover the funds as a part of the closeout process, as appropriate.

All reportable childcare costs including the indirect cost (F&A) as of the FFR reporting date should be provided to SPF as outlined above indicating amounts paid and unliquidated.